Accounting Insights: Understanding the Impact of 1P vs 3P on Financial Statements

Sea Limited, Amazon, and in-depth accounting

This post goes into details on 3P vs 1P accounting treatment. Our next post will touch on GMV accounting conventions and how they can mislead investors into thinking a platform is under monetizing.

1P vs 3P: What are the Implications?

The 1P vs 3P accounting convention is the root of much confusion as it materially skews revenue and margin figures.

The distinction between 1P and 3P transactions is critical to understanding many businesses, particularly ecommerce companies and other platform businesses.

We will walk through this key accounting concept and how it applies using leading South East Asian ecommerce player Sea Limited ($SE) as an example.

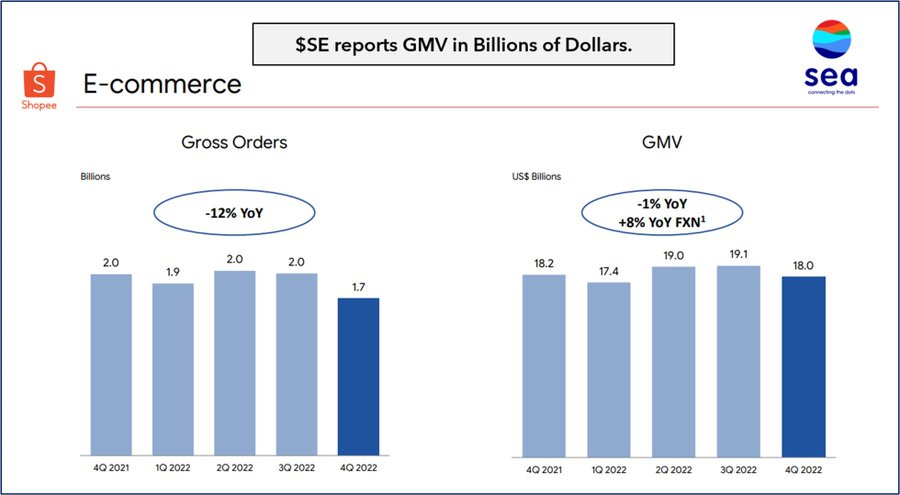

Let’s start with a figure called GMV. GMV stands for Gross Merchandise Value. GMV is the value of transactions that the platform facilitates. Below we see Sea Limited had $18bn in GMV for 4Q22.

Here is a simple example: Selling 10 cases of paper towels at $20 each would equate to GMV of $200. However, the revenue that is recorded on the income statement will vary. The key is whether they are a “principal” or “agent” in the transaction.

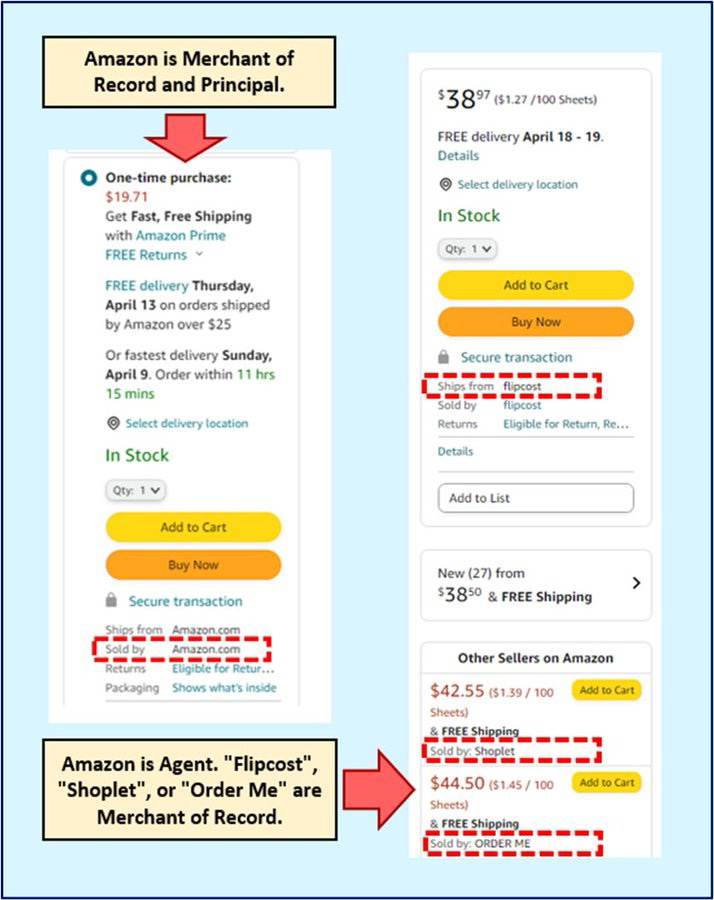

One test is whether the seller is the “merchant of record” (MOR). The MOR is ultimately responsible for the product getting to the buyer, potential refunds, and other liability. Below we see on some transactions Amazon is the MOR and on others a 3rd party is the MOR.

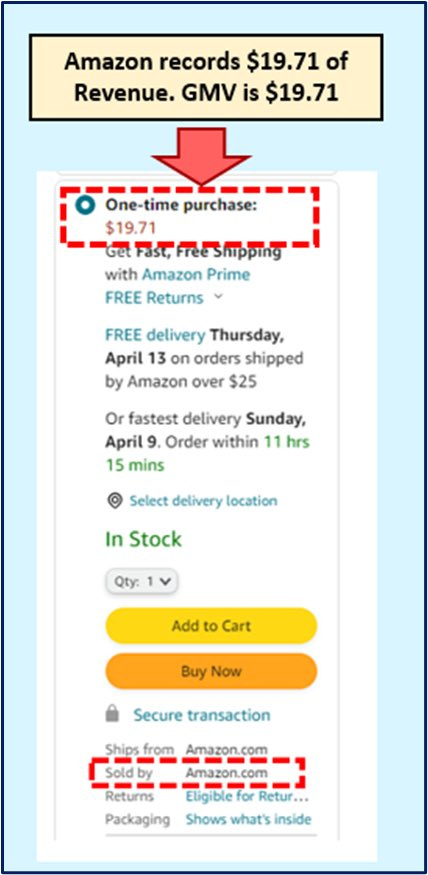

The distinction of whether a platform is a principal or agent in the transaction is key because it will dictate the accounting treatment. On principal transactions, the full GMV is recorded as revenue. In the exp. below that is $19.71 of revenue for Amazon.

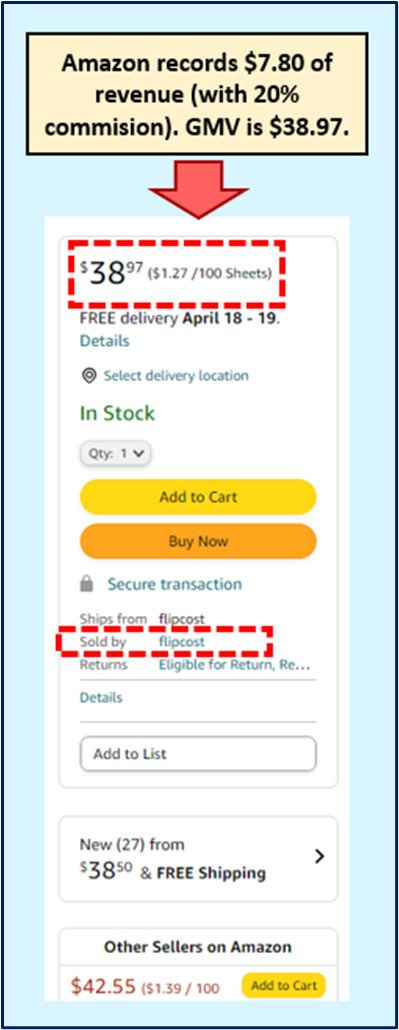

Amazon’s selling fee ranges depending on the service they provide, but let’s say it is 20%. That means on the agent transaction below, they would record only $7.80 as revenue. GMV in this transaction would be $38.97.

When Amazon is a principal in a transaction it is called a first party or 1P transaction. If they are the agent, then it is a third party or 3P transaction.

1P transaction: Revenue = GMV.

3P transaction: Revenue = GMV x Commission (or “Take-Rate”).

There is another big distinction between 1P and 3P transactions: Inventory.

In a 1P transaction the cost of merchandise is recorded in COGS.

In a 3P transaction there is no inventory cost recorded with a sale. This is because the platform is an “agent” and not the MOR. The inventory still belongs to the seller, not the platform.

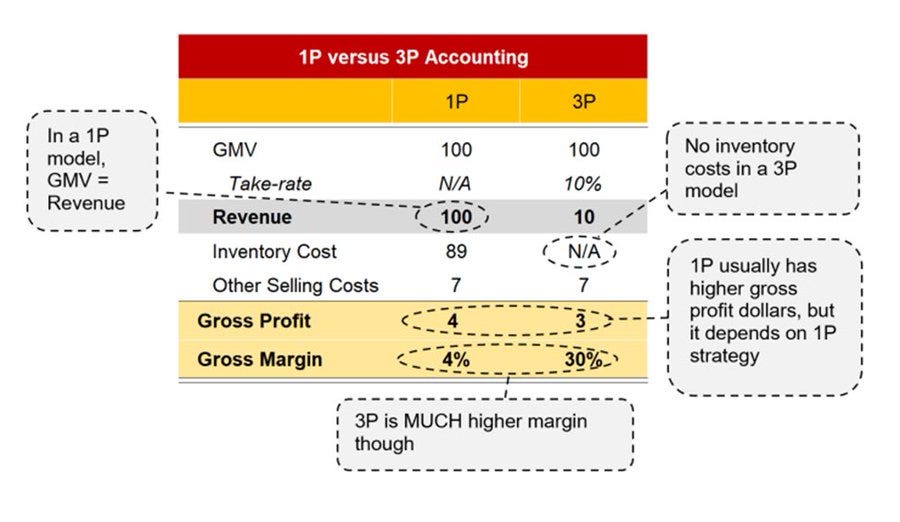

This has huge ramifications for the P&L and margin profile. Look at the gross margin profile difference for selling an item that costs 100 with inventory costs of 89. The gross margin is 4% on 1P vs 30% on 3P. Revenue is 10x larger in a 1P transaction.

1P transactions typically have slightly higher gross profit dollars, but it depends on whether the platform wants to use 1P to drive prices down or as a source of profits. Recall this means that the B/S will not show inventory for 3P transactions, making it “capital light”.

Whether a company records a transaction as 1P or 3P is largely just an accounting difference, but it can change how the business is run. 1P denotes more involvement in every step of the sale, whereas 3P typically just matches buyers to sellers and hands off the transactions.

A lot of platforms now are trying to get the best of both worlds. They use the seller’s capital and product sourcing to offer buyers items, which the platform then helps fulfill (FBA) and guarantees (refunds).

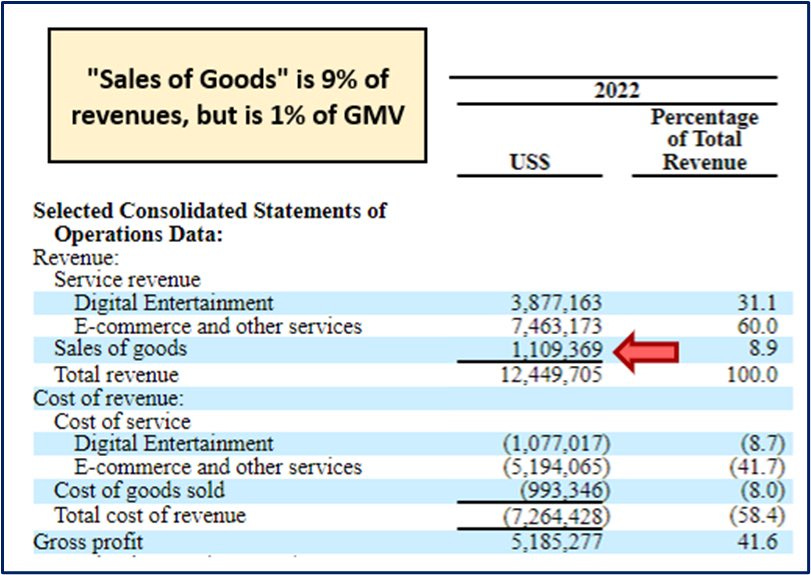

Despite the consumer experience between 3P and 1P looking increasingly similar, the accounting is totally different. Let’s look at Sea Limited. Their “Sale of Goods” item is 1% of GMV, but 9% of revenue.

First, we need to understand Sea’s accounting treatment. We start by going to their Notes in their Financial Statements.

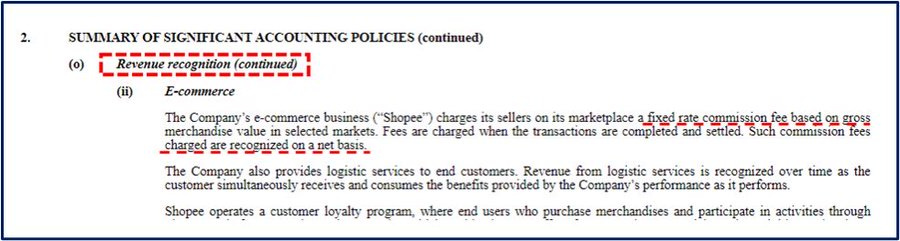

In the footnotes we find disclosures on their revenue recognition. Here we see that Sea’s “ecommerce” revenue is based off a commission of GMV, recorded on a net basis.

GMV x Commission % = Revenue.

This is a 3P transaction.

To get the next part we have to piece together two sections. “Sales of Goods” as defined in their “Operating and Financial Review” and the footnotes. We see that “Sale of Goods” is the purchase of goods from manufacturers and recorded on a gross basis (1P).

This allows us to understand why such a small portion of the business is having an outsized revenue impact.

Remember to keep in mind the 1P vs 3P distinction when looking at financials, especially in ecommerce.

Follow us on Twitter @Speedwell_LLC for more business and investing content!

Good one KG! An important concept well explained. Thanks for sharing